Article 1

GENERAL CONDITIONS

1.1.This Contract is a Hydrocarbon exploration and production sharing agreement. Its clauses are governed by the laws and regulations in effect in Gabon.

1.2.It defines the rights and obligations of the Parties, governs their mutual relationship and establishes the rules and terms for exploration, exploitation and production sharing. It applies to the Petroleum Operations that Contractor is to perform on an exclusive basis in the Delimited Area and any Exploitation Area, it being understood that all substances and products other than Hydrocarbons are beyond the Contract’s scope of application.

1.3.For all the work required for performance of the Petroleum Operations, Contractor is required to comply with generally accepted Hydrocarbon industry practices.

1.4.Contractor shall supply all the financial and technical means necessary for the proper performance of the Petroleum Operations. Subject to written approval of the Petroleum Operations, the Contractor may use Third Parties or Affiliated Companies Funds for the financing of corresponding investments.

The Contractor shall send to the Hydrocarbon Services a certified copy of the loans agreements and contracts which have been obtained and must be concluded under the condition that the above-mentioned approval has been obtained.

However, interest, agios, financial charges of any nature and currency exchange losses arising from such financing, whatever their source and payment terms, are deductible for the purposes of Article 26.4 or chargeable to Petroleum Costs which give rise to recovery under Articles 24 and 26.10, only in the cases and according to the modalities and restrictions provided in said Articles and in the Accounting Agreement.

1.5.The Contractor shall alone bear the financial risk attached to the performance of the Petroleum Operations, subject to the provisions of Article 19.

1.6.Throughout the term of the Contract, the total production originating from the Petroleum Operations will be shared between the Parties according to the terms defined in Articles 24, 25, and 26.

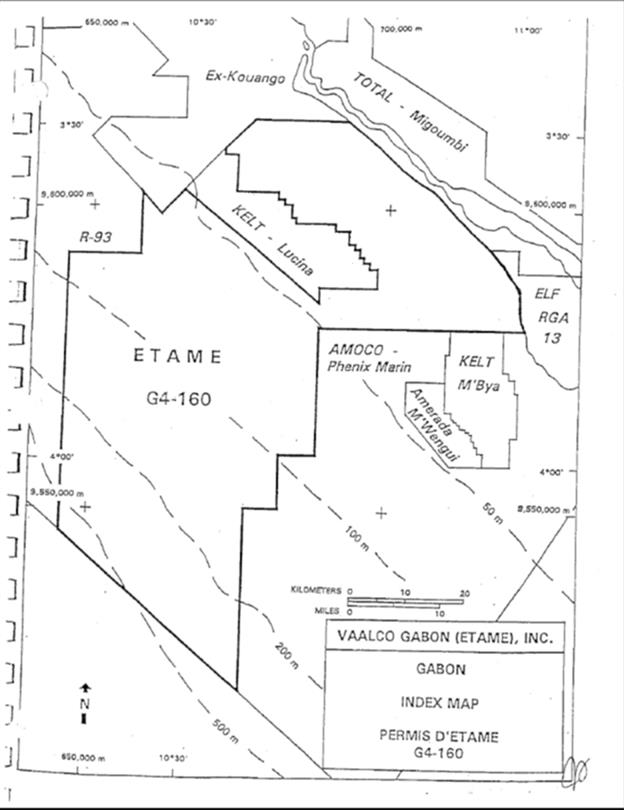

1.7.The Delimited Area is defined in Attachment 1.

1.8.In the month following the Effective Date, the Contractor shall inform the Administration of the name of the designated Operator who will be responsible for performing the Petroleum Operations.

The Operator, in the name and on behalf of the Contractor, shall communicate to the Administration all reports, information and data mentioned in the Contract as well as any contract or convention binding the companies comprising the Contractor. The Operator will act as the designated representative of all the companies forming the Contractor, for the performance

of the Petroleum Operations. The Contractor may at any time designate another Operator, subject to prior approval from the Administration.

1.9.For the practical terms of performance of this Contract, the person responsible for Departments in charge of Hydrocarbons represents the State; he makes all the decisions, grants any necessary or useful authorization for the performance of the Petroleum Operations.

1.10.During the term of the Contract, the State may at any time and particularly at the time of participation pursuant to the provisions of Article 19, delegate the management of its rights and obligations resulting from said participation to a company or organization of its choice.

Article 2

TECHNICAL CONSULTING COMMITTEE

2.1.Within the month following the Effective Date, a Technical Consulting Committee will be formed. It will be composed of the same number of members representing the State and the Contractor. The representatives of the State will be designated from among the Administration supervisory staff, from the General Hydrocarbon Department and from the land, financial, or customs Administration. The Chairman of the Technical Consulting Committee shall be selected from among the representatives from the General Hydrocarbons Department.

2.2.The Technical Consulting Committee is a body responsible for issuing opinions, suggestions and recommendations on:

|

·

| |

the exploration, development and .production work on discovered Fields, and on the related expenditures; |

|

·

| |

the application of the Field conservation rules pronounced by the Administration or, in the absence of such rules, based on commonly accepted Hydrocarbon industry practice; |

|

·

| |

anti-pollution measures and safety and health regulations on the work sites; |

|

·

| |

the choice between purchasing or renting, by the Contractor, of major equipment and facilities, in application of the provisions of Article 10.2; |

|

·

| |

the programs and budgets provided by Articles 5.1 and 20.1, before they are submitted to the Administration for approval; |

|

·

| |

the conditions for personnel employment, in accordance with the provisions of Article 38; |

|

·

| |

the provisions to be taken by Contractor for the training of Gabonese personnel in application of the provisions of Article 39 and the implementation of said provisions; |

Within the framework of its powers, the Technical Consulting Committee may assign studies to subcommittees created for that purpose.

2.3.The opinions, suggestions and recommendations of the Technical Consulting Committee will be adopted by majority of votes, each member being entitled to one vote and with the authority to represent only one other member of the Committee.

The Technical Consulting Committee deliberates validly if at least two thirds of its members are present or represented; the presence of the Chairman or of his representative, if the former is unable to attend, is indispensable.

2.4.The Technical Consulting Committee meets at least twice a year in the exploration period and at least four times a year during the development and exploitation period. Meetings are called at the initiative of the Contractor or the Administration and convened by summons from the• Chairman of the Technical Consulting Committee issued at least fifteen days prior to the meeting date. In emergencies, the members meet as quickly as possible or consult by telex.

Contractor may request that the Technical Consulting Committee be convened in an extraordinary meeting in order to submit specific questions to it.

The agenda is prepared by the Party requesting the meeting; the documents necessary for the proper conduct of the meeting are prepared by Contractor or, if applicable, by the Administration. Contractor will hold the office of Secretary of the Technical Consulting Committee.

2.5.The expenses deriving from the activity of the Technical Consulting Committee, as well as those borne by the Administration within this context will be borne by Contractor and considered as Petroleum Costs.

Article 3

EXPLORATION PERIODS

3.1.On the effective date, the Contractor is granted an Exclusive Exploration Authorization on the Delimited Area for a first period of three years Contractual Years. This period may be extended at Contractor’s request, presented at least forty‑five days before expiration of this period, by a maximum of three months to permit Contractor to complete any drilling then in progress.

This extension will be granted by decision of the Departments in charge of Hydrocarbons.

Nevertheless, Contractor shall make its best effort to start drilling so that, under normal circumstances, the drilling operations can be completed before the normal expiration of the above-mentioned Period.

3.2.If, during the first extension period granted pursuant to Article 3.1, the Contractor has fulfilled the obligations deriving from this Contract, in particular the work obligations defined in Article 4, the Exclusive Exploration Authorization shall be extended at the request of Contractor for a second period of three Contractual Years.

The second period may also be extended by a maximum of three months for the same reasons and under the same conditions as those stated in Article 3.1.

Contractor must file its renewal application for the second period at least thirty days prior to expiration of the first period. If Contractor has benefited from the extension described in Article 3.1, the above-mentioned thirty‑day term is counted from the end of said extension, in order to allow Contractor to examine and evaluate the results from drilling and to determine the desirability of filing a renewal application. Renewal will be granted through edict from the Minister of Hydrocarbons.

3.3.At the end of the first period, in the event that that the Exclusive Exploration Authorization is not renewed, Contractor must surrender all the Delimited Area, with the exception of the Exploitation Areas or surface areas for which it has filed an application for an Exclusive Exploitation Authorization which is being processed.

Article 4

WORK COMMITMENTS DURING THE EXPLORATION PERIOD

4.1.During the exploration period defined in Article 3.1, Contractor shall perform at least the following work:

|

·

| |

acquire and process 1,500 km of 2-D seismic data and shoot one 3-D seismic survey; |

|

·

| |

Re-process and make a reinterpretation of existing, available seismic data; |

|

·

| |

Prepare a feasibility study of the development of the Tchibala North South discoveries within the first six months; |

|

·

| |

Drill one exploration well. |

In order to carry out this work program under the best technical conditions in accordance with generally accepted Hydrocarbon industry practices, Contractor will invest an a mount estimated at US $7,800,000.

Contractor is required to start the geological and geophysical work covered by the above commitments within four months after the Effective Date.

4.2.During the second exploration period defined in Article 3.2, Contractor shall carry out the following minimum work:

|

·

| |

acquire and process 2,000 km of 2-D seismic data and shoot a 3-D seismic survey if the exploration well was a discovery; |

|

·

| |

drill two exploration wells. |

In order to carry out this work program under the best technical conditions in accordance with generally accepted Hydrocarbon industry practices, Contractor will invest an amount estimated at US $14,500,000.

4.3.The above-specified wells will be drilled to a minimum depth 2,500 (two thousand rive hundred) meters or until the Gamba geological formation is penetrated for at least fifty meters if it extends beyond the contractual depth. If at 2,500 meters, said geological formation has not been encountered, the Parties will meet in order to examine the desirability of continuing the Well in the interest of each.

Drilling will be stopped at a lesser depth than originally estimated if, having drilled the well in accordance with approved practices of the Hydrocarbon industry, the stoppage is justified by one of the following reasons:

|

·

| |

the Gamba formation is encountered at a lesser depth than the contractual depth; in this case, the Parties will meet to examine the desirability of continuing the well in the interest of each; |

|

·

| |

basement is encountered at a lesser depth than projected; |

|

·

| |

continuation of drilling presents an obvious hazard because of the presence of abnormal formation pressure; |

|

·

| |

rock formations are encountered the hardness of which renders it impractical to continue drilling with standard equipment; |

|

·

| |

Hydrocarbon-bearing formations are encountered which; before being penetrated, must be protected by setting casing, thus preventing attainment of the contractual depth. |

In the event that drilling is stopped for any of the above-listed reasons, the well shall be considered to have been drilled to the contractual depth, provided that the Contractor timely presents its reasons to the Administration and the Administration accepts these reasons as justified.

4.4.The Contractor is required to meet its work commitments for an exploration period even if this entails for the Contractor exceeding the amount estimated for that period.

On the other hand, if Contractor has met the work commitments for an amount less than the amount estimated for that period, it is considered to have met those commitments.

4.5.If the Administration notices that’ Contractor has not met its work commitments during an exploration period, it will so advise Contractor in writing. The procedure provided by Article 48.10 is then applicable, as required.

Article 5

PREPARATION AND APPROVAL OF ANNUAL WORK

PROGRAMS AND CORRESPONDING BUDGETS

5.1.Within a maximum of two months after the Effective Date, Contractor shall submit to the Administration for approval an Annual Work Program and the corresponding Budget for the entire Delimited Area, specifying the Petroleum Operations for the period from the Effective Date until the following December 31.

By September 30 of the Calendar Year, Contractor shall submit to the Administration for approval an Annual Work Program and the corresponding Budget for the entire Delimited Area, specifying the Petroleum Operations it intends to perform during the subsequent Calendar Year.

The Annual Work Program and the corresponding Budget mentioned above shall be examined by the Technical Consulting Committee, in accordance with the provisions of Article 2.2 prior to being submitted for Administration approval; the advice, suggestions and recommendations of the Technical Consulting Committee must be attached.

5.2.If the Administration believes that modifications of the Petroleum Operations planned in the Annual Work Program are necessary or useful, it shall notify the Contractor in writing, within thirty days after receipt of the Program, stating the requested modifications and including any justifications it deems appropriate. The Administration and the Contractor will meet as soon as possible in order to study the modifications requested and in order to prepare by mutual agreement the Annual Work Program and the corresponding Budget in their final form.

In any case, the parts of the Annual Work Program for which the Administration did not request modifications are considered approved and must be completed by the Contractor within the initially agreed times.

If the Administration does not address a request for modifications to the Contractor before expiration of the thirty-day period, the Annual Work Program and the corresponding Budget shall be deemed thereby approved.

5.3.If the information acquired as the operations progress or particular circumstances justify certain minor changes in the Petroleum Operations planned in the Annual Work Program which do not affect the pursuit of the primary objectives by the Contractor, the Contractor may make the corresponding changes after approval from the Hydrocarbon Departments, provided that the basic established objectives are not changed.

Article 6

RELINQUISHMENTS

6.1.Contractor may relinquish all or part of the Delimited Area, subject to application of the provisions of Article 7.

6.2.During the first exploration period defined in Article 3.2, only to the entire Delimited Area may be relinquished, subject to the provisions of Article 6.5.

6.3.During the second exploration period defined in Article 3.2, all or part of the Delimited Area may be relinquished.

6.4.Contractor must inform the Administration in writing of its decision to relinquish acreage, specifying, if applicable, the part of the Delimited Area which is to be relinquished. Said relinquishment becomes effective six15ty days after receipt of the above-mentioned written notice, unless the Administration agrees to the effectiveness of the waiver for an earlier date.

Within thirty days after the effective date of the relinquishment, Contractor must submit to the Administration a detailed report, together with appropriate supporting documentation, on the work performed in the Delimited Area and the corresponding expenses.

6.5.When relinquishing areas held under en exploration contract, Contractor has the right to retain the Exploitation Areas or surface areas for which it has filed an application which is being processed.

6.6.In the event of a partial relinquishment, each of the relinquished areas must be sufficiently large to allow further hydrocarbon operations to be carried out and must be of simple shape and defined by geographic coordinates.

6.7.Partial relinquishment during the second exploration period does not cause the Contractor’s work commitments defined in Article 4.3 to be reduced; the part of work not yet completed on the effective date of the partial relinquishment is carried over to the remaining part of the Delimited Area.

Article 7

INSUFFICIENCY OF EXPLORATION WORK

7.1.In the event of relinquishment of all of the Delimited Area, as described in Articles 6.1 or 6.2, and if Contractor’s work commitments as defined in Article 4, have not been met, Contractor is required to pay to the State, within thirty days after the effective date of the relinquishment, on the basis of provisions of Article 6.4, a compensation equal to the cost of the exploration commitments which have not been met at the date of the relinquishment.

7.2.Within thirty days of the expiration of either the first or the second exploration period defined in Article 3, Contractor presents to the Administration a detailed report, with

appropriate supporting documents, on the work performed in the Delimited Area and on the corresponding expenditures.

7.3.If at the expiration date of any of the exploration periods, Contractor has failed to meet its work obligations as defined in Article 3, Contractor is required to pay to the State, within thirty days following the date of expiration of the period involved, a compensation corresponding to the value of the work not done, as estimated on that date.

7.4.In the event of a delay in the payment of the compensation due to the State under the terms of Article 7.1 and 7.3 these amounts due will bear interest, calculated from the day the payments were due until the date of payment by Contractor, at the annual discount rate of the Bank of Central African States (B.E.A.C.) plus three percentage points.

7.5.If the compensations estimated in Article 7.1 and 7.3 are less than those actually due, the difference, plus the interest defined in Article 7.6, calculated from the day on which these compensation payments should have been made, is paid to the State as soon as possible.

7.6.The amounts which have not been paid on the dates due are increased by a penalty interest defined by the annual discount rate of the, Bank of Central African States (B.E.A.C.) plus three percentage points.

Article 8

CONTRACTOR’S OBLIGATIONS DURING

THE EXPLORATION PERIODS

8.1.The Contractor furnishes all the necessary funds for the expenses required for the performance of the Petroleum Operations defined in the Annual Work Program.

The Contractor will perform the Petroleum Operations by using either its own materials, equipment and supplies or those acquired or rented to this effect, subject to the provisions of Article 10.3.

8.2.The Contractor is responsible for the performance of the Annual Work Programs. The work must be performed under the best conditions of cost and efficiency; in general, the Contractor will utilize all appropriate means for the execution of the Annual Work Programs under the best economical and technical conditions for the Parties, in accordance with the most appropriate practices generally accepted in the Hydrocarbon industry.

8.3.The Contractor agrees to take all practical measures in order to:

(a)ensure protection of the aquifers encountered:

|

·

| |

while drilling, through proper cementing of the casing in the. wells, |

when abandoning unproductive wells, by applying cement plugs so as to isolate the formations under pressure from other reservoir horizons and from the surface.

(b)carry out the tests necessary to determine the value of the Hydrocarbon shows encountered while drilling and the exploitability of any Fields discovered.

8.4.The facilities erected and work performed by the Contractor offshore under this Contract shall, according to their nature and the circumstances, be built, positioned, marked, buoyed, equipped and maintained in such fashion as to permanently allow free safe passage to navigation at all times in the waters of the Delimited Area.

Independently of the above provisions, in order to facilitate navigation, the Contractor shall install sound or visual devices approved or required by the competent authorities and maintain them to the satisfaction of said authorities.

8.5.At the time of construction and maintenance of the facilities necessary for the performance of the Petroleum Operations, the Contractor shall not disturb any previously installed cemetery or any existing building used for religious purposes. Moreover, Contractor must not in any way cause any problem which may affect normal use of a building without the occupants’ consent. The Contractor is required to pay due compensation for damage or disturbance thereby caused to Third Parties.

8.6.In application of the International Convention on the Pollution of Sea Water by Hydrocarbons signed in London on May 12, 1954, its amendments and implementation provisions, the Contractor undertakes to take all the necessary precautions to prevent marine pollution.

To this effect, the State may decide, in agreement with the contractor, on any additional measures it may deem necessary in order to ensure preservation of the marine zone.

8.7.Under similar conditions of price, quality, and delivery, Contractor agrees to use Gabonese companies for its procurement, work and service contracts.

For all contracts that may reach or exceed one million US dollars (US$ 1,000,000), the choice of companies shall be by call for bids.

A copy of all the contracts mentioned in the preceding paragraph concluded by the Contractor and pertaining to the Petroleum Operations will be addressed to the Administration as soon as said contracts are signed.

The Contractor will inform the Departments in charge of Hydrocarbons at least fifteen days in advance of the date, time and place of opening of the bids. The person responsible for these Departments or his representatives may participate in the opening and examination of the bids.

The information made available to the participants in the opening and examination of the bids must be communicated at the same time to the Departments in charge of Hydrocarbons.

A list of all ‘the contracts concluded by the Contractor during each calendar quarter for performance of the Petroleum Operations is forwarded for information to the Administration, within fifteen days following the end of said calendar quarter. For each contract, the subject and

the amount, together with the name of the co-contracting party will be specified. The Contractor forwards to the Administration copies of the contracts which may be requested by the latter.

Article 9

RIGHTS IN CONNECTION WITH THE EXPLORATION PERIODS

9.1.Subject to the special provisions of the Contract, Contractor has the rights the exercise whereof affects the performance of the Petroleum Operations in the Delimited Area and to all possible facilities to that end. These rights include specifically:

(a)Full responsibility for the administration, control, and conduct of all the Petroleum Operations;

(b)The option to exercise the rights and powers conferred by the Contract through independent agents and independent contractors whose salaries, expenses, and fees it pays in compliance with the regulations in force in Gabon on financial transactions and subject to the provisions of Article 8.7.

9.2.Subject to the regulations in effect and the provisions of Article 8.5, the Contractor will have the right to clear the land, to excavate, drill, bore, construct, erect, place, procure, operate, administer and maintain ditches, tanks, wells, trenches, excavations, dams, canals, water mains, plants, reservoirs, basins, offshore and onshore storage facilities, primary distillation units, first extraction gasoline separation units, sulfur plants and other facilities for the production of Hydrocarbons, in addition to pipelines, pumping stations, generator sets, power plants, high voltage lines, telephone, telegraph, radio systems and Other communications facilities, factories, warehouses, offices, sheds, houses for employees, hospitals, schools, premises, ports, docks, harbors, dikes, jetties, dredges, breakwaters, underwater piers and other facilities, ships, vehicles, railways, roads, bridges, ferryboats, airlines, airports and other transportation facilities, garages, hangars, workshops, foundries, repair shops and all related auxiliary services and, in general, all that which is necessary for performance of the Petroleum Operations.

The location of these facilities may be selected by the Contractor subject to the regulations and provisions of Articles 8.5, 13 and 14.

9.3.The agents, employees and representatives of the Contractor or of its subcontractors shall be allowed to enter or leave the Delimited Area and to have free access in keeping with their functions to all the facilities installed by the Contractor for performance of the Petroleum Operations.

Article 10

OWNERSHIP OF THE ASSETS

10.1.The real property such as wells, buildings and associated equipment, piers, roads, bridges, canals, ports, docks, dikes, jetties, water mains, pipelines, reservoirs, basins, railways, land, structures, warehouses, offices, plants and permanently-installed machinery and equipment purchased or built by the Contractor, as well as all movables thereby purchased or manufactured within the framework of the Petroleum Operations are the property of the State.

The Contractor may utilize at no charge said real property and movables within the framework of the Contract. The Contractor may also use said property for other petroleum operations under other contracts to which it is a. party, subject to payment of a properly calculated rental price, approved by the Administration. These proceeds are entered in the Petroleum Costs account and Will reduce said Costs. They are paid to the State if the Petroleum Costs yet to be recovered correspond only to exploitation expenses.

The Contractor will contract, regarding these assets, on behalf of the State, all the necessary insurance policies, according to generally accepted practices. The insurance premiums paid to this effect are included in the Petroleum Costs. The indemnities collected in the event of claim are entered in the Petroleum Costs account and will reduce said Costs. They are paid to the State if the Petroleum Costs yet to be recovered correspond only to exploitation expenses, unless they are allocated to replacement of lost or destroyed assets.

10.2.The provisions of Article 10.1 above are not applicable to assets belonging to Third Parties or Affiliated Companies and leased to Contractor under a lease or simple rental agreement.

10.3.Under equivalent economic conditions, Contractor commits itself to give priority to buying goods instead of leasing or renting.

For major equipment and facilities, before opting for purchase or lease, Contractor shall procure the opinion, suggestions and recommendations of the Technical Consulting Committee and submit its duly justified choice for the Administration’s approval. This choice will become final after the approval from the Administration has been obtained.

At the time of review of the Annual Work Program and corresponding Budget, the Administration will designate the major equipment and facilities appearing on said documents, for which the Technical Consulting Committee must be consulted and the Administration’s approval requested.

Article 11

ACTIVITY REPORTS DURING THE EXPLORATION PERIODS

11.1.The State, through the Departments in charge of Hydrocarbons, will have access to all the original data in connection with the Petroleum Operations, such as geological, geophysical, petrophysical, drilling and exploitation reports, in addition to any technical,

accounting and financial information which it may deem useful for the exercise of its power of verification.

11.2.Immediately after they have been prepared or obtained, the Contractor shall furnish the following reports or documents to the person responsible for the Departments in charge of Hydrocarbons:

(a)a copy of the geophysical survey and interpretation reports and a complete set of maximum processed seismic profiles on stable transparent material, such as “Mylar”; a copy of the magnetic tapes will be kept by the Contractor and made available to the person responsible for the Departments in charge of Hydrocarbons;

(b)a copy of the daily telexes on the wells being drilled and a copy of the spud-in and end-of-drilling reports for each well drilled, in addition to a complete set of all logs recorded in reproducible form;

(c)a copy of the reports on production tests performed and of any study pertaining to the commencement of production of a well;

(d)a copy of each core sample analysis report,

A representative portion of the cores or cuttings obtained at each well and samples of the fluids produced during the production tests will also be furnished within a reasonable period. Any core samples and cuttings in the Contractor s possession at the time of expiration of the Contract will be delivered to the person responsible for Hydrocarbons.

11.3.During the second half of each month, the Contractor shall furnish to the Departments in charge of Hydrocarbons a report on the Petroleum Operations of the previous month.

11.4.Contractor is required to inform the Departments in charge of Hydrocarbons in the shortest possible time of any discovery of mineral substances and to report on any pertinent observations or information relative thereto.

11.5.The State is the owner of any original documents, reports prepared or obtained by the Contractor or samples relative to the Petroleum Operations, geological, geophysical, and petrophysical work, synthesis reports, well logs, even if in the Contractor’s possession, to be used within the framework of the Petroleum Operations. The Contractor may retain copies of these samples, documents and reports for the requirements of the Petroleum Operations.

Each Party assumes the obligation, each as applicable to it, in its own behalf and in the behalf of the service companies or consultants working for it, to consider these documents, reports, Operations, studies and samples confidential and not to reveal them to Third parties without prior consent from the person responsible for the Departments in charge of Hydrocarbons. This obligation continues, for the State, during the exploration periods defined in Article 3 and, in the event of total surrender, in application of the provisions of Article 6, until the effective date of said surrender, and, for the Contractor, even after the end of the Contract.

Each entity forming the Contractor may, without the consent of the other entities or of the Administration, disclose the following confidential information and data:

(a)To each company interested in good faith in the realization of an eventual transfer or of assistance in the framework of Petroleum Operations, after the undertaking by said company to keep this information confidential and to use it only for the realization of said transfer or assistance; or

(b)To any independent professional consultants operating within the framework of the Petroleum Operations, after obtaining from them a similar confidentiality agreement, provided that the Contractor reports immediately to the Administration the names of said consultants and the information and data disclosed thereto; or

(c)To any bank or financial institution with which the Contractor is attempting to obtain or obtains financing, after obtaining a similar confidentiality agreement from these concerns,

(d)When and insofar as the regulations of a recognized stock exchange require it, unless this is in conflict with the laws of Gabon.

(e)Within the framework of any contentious judicial, administrative or arbitrage procedure.

With prior written consent from the Administration, the Contractor may exchange with any interested party any confidential information or data of this type against other similar information or data.

Article 12

NATURAL RESOURCES

The Contractor shall have the right, if applicable, in exchange for payment of any applicable royalty and subject to compliance with the regulations in force and the provisions of Article 8.5, to remove and use the topsoil, fully-grown timber, clay, sand, lime, gypsum, stones (other than precious stones) and other similar substances which may be necessary for the performance of the Petroleum Operations.

The Contractor shall make reasonable use of such materials for the performance of the Petroleum Operations.

The Contractor may take or -use the water necessary for the Petroleum Operations provided that existing irrigation or navigation does not thereby suffer and that land, houses or watering points are not thereby deprived of their use.

Article 13

UTILIZATION OF LAND

13.1.The State will make available to Contractor for the needs of the Petroleum Operations, the State-owned land necessary for said operations. The Contractor may construct and maintain, above and below grade, the facilities necessary for the Petroleum Operations. The Contractor shall not request the use of said land unless it has a real need therefor and it shall refrain from claiming any land occupied by buildings or properties utilized by the Administration. The Contractor shall compensate the State for any damage to the land caused by the construction, maintenance and use of its facilities.

Subject to the regulations in force, the Administration will authorize the Contractor to construct, use and maintain telecommunication systems and pipelines, above and below grade and along land which does not belong to the State, provided the construction, maintenance and use of these systems cause the least possible damage and that they are in accordance with the regulations.

13.2.In the event it is necessary -for the Contractor, in order to perform the Petroleum Operations, to occupy and use land belonging to private parties, the Contractor shall endeavor to reach an amicable agreement with the property owners to determine equitable compensation for the loss of use suffered. In the event of disagreement, the Contractor shall inform the Administration which can:

either set a compensation to be paid by the Contractor, if the occupation of the land is of short duration. The amount of the compensation will then take into account the effective use of the land by the landowner at the time of occupation.

or expropriate the land, in accordance with the applicable regulations, if the occupation is long-lasting or makes it henceforth impossible to resume the original use of the land. The rights are acquired and recorded by the Government in the latter’s name but the Contractor is entitled to free use thereof for the Petroleum Operations for the entire duration of the Contract. The costs, expenses and indemnities resulting from the expropriation procedure will be borne by the Contractor.

Article 14

UTILIZATION OF FACILITIES

14.1.The Contractor will have the right to utilize, under the provisions of common law, for the needs of the Petroleum. Operations any railway, tramway, road, airport, landing field, canal, river, bridge or waterway and any telecommunication network, whether owned by the State or by private companies, against payment of any royalties in force or to be established by mutual agreement, in exchange for this use and their construction, operation and maintenance. The Contractor will also have the right to use for the Petroleum Operations any means of land,

sea or air transportation, subject to the laws and regulations governing the use of such means of transportation.

14.2.The State will have the right in exceptional cases to use any transportation and communication facility installed by the Contractor, such as in case of national necessity due to national catastrophes, disasters, internal or external peril. The Contractor shall make all its facilities available to the State at the latter’s simple request or requisition. In such case, the request shall come from the Minister in charge of Hydrocarbons.

14.3.The State can construct, operate and maintain, above and below the land made available to the Contractor or along roads, railways, airports, landing fields, canals, bridges, flood Protection dams, police stations, military installations, pipelines and telecommunication networks, provided this does not compromise or significantly hinder the performance of the Petroleum Operations, except in case of national necessity.

Article 15

EXPIRATION OF CONTRACT AT THE END

OF THE EXPLORATION PERIOD

If, during the exploration periods, Contractor has made no discovery of Hydrocarbon deposits presumed to be commercially exploitable or declared as such and giving entitlement to an Exclusive Exploitation Authorization, the Contract is terminated at expiration of said period.

Expiration of the Contract will not relieve the Contractor of its contractual obligations arisen prior to the date of said expiration and not yet honored, entirely or in part, on said expiration day. The Contractor is required to meet these obligations in accordance with the regulations and the contractual provisions; the validity thereof is extended to this effect.

Article 16

DISCOVERY AND EXPLOITATION OBLIGATION

16.1.If the Contractor discovers Hydrocarbons, it shall notify the Administration in writing within ten days after completion of the tests making it possible to presume the existence of a field.

16.2.The commercial or presumed commercial nature of a Field is determined by the Parties. The Parties shall meet to this effect and shall record their agreement on this matter in a jointly signed document.

16.3.To this end, Contractor is required to supply all information enabling the Administration to make a detailed review of the data relative to the discovered Field and to make its decisions in full cognizance of the facts as to the commercially exploitable nature of the discovery. This information is to be supplied as it is obtained by Contractor.

16.4.Provided Contractor has met its commitments and obligations under the Contract, and especially Article 16.3, a Field considered to be commercially exploitable in application of

the above provisions will entitle it .to an Exclusive Exploitation Authorization on the area involved which will be considered an Exploitation Area after the effective date of this Exclusive Exploitation Authorization and will be limited to the presumed size of the Field, projected to the surface, determined on the basis of available geological and geophysical data.

The Exclusive Exploitation Authorization is granted by official decision of the Minister of Hydrocarbons at Contractor’s request, filed in the form and terms of Article 17.1

16.5.If the Contractor makes several commercially exploitable discoveries within the Delimited Area, each of these will entail a separate Exclusive Exploitation Authorization corresponding to a separate Exploitation Area. However, for the requirements of Articles 24, 25 and 26.1, the overall production from the Exploitation Areas of the Delimited Area is taken into account.

16.6.The quantities of Hydrocarbons produced before a Field is declared commercially exploitable in application of the provisions of Article 16.2, will be measured in accordance with the provisions of Article 29 and will be subject to the provisions of Articles 24 to 26, with the exclusion of those used for the needs of the Petroleum Operations or lost, provided, however, that for these quantities the Contractor supplies to the Administration all useful explanations and justifications.

16.7.For any Field declared or presumed commercially exploitable in accordance with the provisions of Article 16.2, the Contractor assumes the obligation to perform all useful and necessary Petroleum Operations for exploitation of said Field.

The Contractor is required to inform the Administration in writing of the starting date of production as soon as this is effective.

After the award of an Exclusive Exploitation Authorization, the State shall not require that the Contractor continue exploitation of the corresponding Field if it provides evidence, on the basis of the technical information acquired on the Field and of accounting and financial justifications, of the non‑profitability of the exploitation.

In this case, the Exclusive Exploitation Authorization expires on the date on which the operations or the production are stopped and the corresponding Exploitation Area becomes free on said date. The State has then the right to exploit the Field on its own, without being required to pay any indemnity to the Contractor.

16.8.Except for duly justified exceptional circumstances, if production from a Field has not begun within three years after the date of award of the Exclusive Exploitation Authorization, this authorization is canceled and the Contractor’s rights are considered voluntarily relinquished. Cancellation is pronounced by decree from the Minister in charge of Hydrocarbons.

Article 17

APPLICATION FOR EXCLUSIVE EXPLOITATION AUTHORIZATION

AND DELIMITATION OF EXPLOITATION AREAS

17.1.To obtain an Exclusive Exploitation Authorization, Contractor must file an application with the Minister in charge of Hydrocarbons.

The aforementioned application, as well as the attachments and data provided, must be written in French or must be accompanied by a duly certified translation. They are to be dated and signed by the applicant.

The application, as well as the attachments and data provided, must be prepared in triplicate; the first two copies, one of which must have a stamp, are to be filed with the Directorate of Hydrocarbons, the- third is to be filed with the Minister in charge of Hydrocarbons.

The applicant must prove his identity and indicate the elected domicile; if the applicant is acting as a proxy, it must prove its identity, its domicile and its powers.

The applications presented in application of this Article must provide, for all companies making up the Contractor, information concerning their registered offices, authorized capital and the full names, nationalities, titles, and addresses of the persons making up, according to the bylaws, the management, the administration and the board of these companies and persons with signatory power.

Any application filed for a company must include the powers of attorney of the person(s) who signed the application, as well as a certified copy of the bylaws of the company, of the certificate of its incorporation and of the balance sheets of the last three financial years.

The application must include:

|

·

| |

the proposed limits of the Exploitation Area, which must be strictly confined to the presumed size of the Field discovered, as projected to the surface; |

|

·

| |

supporting documents (geological and geophysical interpretations, wireline logs, etc.) used as basis for determination of the presumed extent of the Field; |

|

·

| |

the provisional estimate of recoverable reserves and the annual production of the Field; |

|

·

| |

a plat of map on a scale of 1:200,000 showing the geographic boundaries of the Area of the application; |

|

·

| |

a report summarizing the results of the exploration efforts carried out in the Delimited Area and providing the location, a description and the characteristics of the Field; |

|

·

| |

a general outline of the development plan for the Field and an estimate of the capital expenditure required for the development and the exploitation of the Field; |

|

·

| |

a provisional program for the training of Gabonese Nationals. |

17.2.Any later modification in the bylaws, legal form or capital of the companies forming the Contractor, as well as any change of the individuals mentioned in the fifth paragraph of Article 17.1, must be reported without delay to the Minister in charge of Hydrocarbons and to the person responsible for the Departments in charge of Hydrocarbons.

The Contractor is to send annually to the aforementioned copies of its constituent entities’ balance sheets and accounting records submitted for approval to their stockholders’ meetings and any reports from their management and administration presented at these meetings to this effect.

17.3.The right to obtain an Exclusive Exploitation Authorization will remain in effect only if the application is received by the Administration within six months after the date of the signature of the document specified in Article 16.2 and, in any case, before the expiration date of the second exploration period. If a reply is not received within the above-mentioned time frame after receipt of the application, the latter is considered accepted by the Administration.

17.4.The applications for renewal of the Exclusive Exploitation Authorization mentioned in Article 18.1 must be presented not later than 90 days prior to the expiration date of the previous Exclusive Exploitation Authorization under the same forms as those set forth in Article 17.1.

17.5.If, during the course of the year following the award of an Exclusive Exploitation Authorization, the extensions of the Field appear to be greater than those of the Exploitation Area, the Minister of Hydrocarbons will grant by Edict to the Contractor, at the latter’s request, within the framework of the previously granted Exclusive Exploitation Authorization, an additional surface area such that the entire Field may thus be covered, on the condition, however, that said additional surface area is part of the initial Delimited Area. The Contractor may not benefit from such an extension if the surface area in question has already been awarded to a third party or is the subject of an application for award then being reviewed.

Article 18

TERM OF VALIDITY OF THE EXCLUSIVE

EXPLOITATION AUTHORIZATION

18.1.The Exclusive Exploitation Authorization is granted to the Contractor through Edict by the Minister in charge of Hydrocarbons; it will go into effect on the date of the award. Its maximum duration is ten years.

If, at the end of ten-year term, commercial exploitation of an Exploitation Area is still possible, the Exclusive Exploitation Authorization for that Exploitation Area is renewed at the Contractor’s request, through Edict from the Minister of Hydrocarbons for a maximum of five years, provided that the Contractor has met its obligations and commitments under this Contract.

The Exclusive Exploitation Authorization is renewed a second time for a maximum of five years, under the same conditions as stated above.

When a renewal is considered and taking into account the financial results obtained by the Parties during the preceding Period, said Parties may agree to new provisions for Articles 24 through 26.

18.2.At any time, the Contractor may relinquish an Exclusive Exploitation Authorization. The Contractor must inform the Administration by letter of its decision to relinquish it and this renunciation will become effective sixty days after receipt of this letter, unless the Administration agrees to a closer date of effectiveness of said renunciation. In the event of relinquishment, the Exploitation Area becomes free on the effective date of the relinquishment.

18.3.The Contract expires on the date of expiration of the last Exclusive Exploitation. Authorization or, when applicable, on the effective date of the above-mentioned relinquishment; however, the Parties are not released from their contractual obligations arisen prior to exploitation of the Contract which may not yet have been honored, entirely or in part, on the date of said expiration. The Parties are required to comply with the regulations and contractual provisions; the validity of these is extended to this effect.

Article 19

STATE PARTICIPATION

19.1.As soon as a Field is placed on production, the State automatically participates, at a rate of 7.5 percent, in the rights and obligations deriving from the Contract, unless it expressly waives the right to participate within ninety days after the above-mentioned production starting date.

The State participates, at the above-mentioned percentage, in the Petroleum Costs regarding development and exploitation of the Exploitation Area, except for any exploration expense.

If the State wishes to take an additional interest, it will inform the Contractor in writing, specifying the percentage interest which it decides to hold. The conditions for acquisition of the additional interest are mutually agreed upon between the Parties.

19.2.The State may at any time transfer to an entity of its choice all or part of its interest.

This state may, however, transfer its interest only to a company controlled by the State or to a company with a well-established technical and financial reputation; if the assignee is a subsidiary, or a branch office, the State will assure that the parent company guarantees its commitments as per provisions in Article 46.2. The Contractor will be consulted prior to any transfer of interest.

The rights and obligations arising from the partnership agreements binding the entities comprising the Contractor must in no event limit the State’s rights or aggravate its obligations under its participation, nor shall they decrease the extent or effects of said participation.

19.3.As from the date on which production begins, the State reimburses, in cash or in kind, its share of the Petroleum Costs incurred for development since the award date of the Exclusive Exploitation Authorization to the companies forming the Contractor, in addition to the sums corresponding to the calls for funds for the Petroleum Costs advanced by the other partners for the exploitation costs.

The above-mentioned choice of payment is exercised by the State through letter addressed to the Contractor within ninety days; failing this, it is considered having opted for payment in kind.

If the State chooses to pay in cash, payment will be made from the net proceeds from the sale of the production share to which it is entitled as a result of its participation, in accordance with the provisions of Article 41.

If the State chooses to pay in kind, payment will be made at the end of each calendar month, by turning over a portion of the production to which it is entitled as a result of its participation.

Whatever the method of payment, the amount to be paid by the State is limited to seventy percent of the net production, or as the case may be, of the portion of the production to which it is entitled as a result of its participation during the calendar month considered. The unpaid balance, if any, is added to the payments owed at the end of the following month; this carrying forward shall not, however, cause the above-mentioned seventy percent limit to be exceeded. Consequently, the total of any balances and of subsequent calls for funds is obligatory only to the above limit, and the surplus will be carried forward and paid under the same conditions defined hereinabove.

Payments made on behalf of the State which have not been recovered by Contractor, constitute a credit due to the Contractor and can be recovered without limitations from the last lifting preceding the expiration of the Contract.

For the purposes of this Article, the quantities of Hydrocarbons turned over as payment by the State will be calculated at the “Fixed Price” defined in Article 27.

19.4.The Contractor will keep up-to-date a “State-Participation” account. This account will be debited with the Petroleum Costs that are attributable to the State by reason of the period prior to its assumption of its participation, as well as at the end of each calendar month, of its monthly share of the Petroleum Costs. The account is credited, at the end of each calendar month, by the Fixed Price of the Hydrocarbons delivered as payment by the State for said month and by the amounts paid by the latter.

The payments owed by the State as reimbursement of its share of Petroleum Costs for development and exploitation, are increased, if applicable, by simple interest calculated at the annual discount rate of the Bank of Central African States (B.E.A.C.).

Article 20

DEVELOPMENT PROGRAM

20.1.Within one hundred and eighty (180) days after the award of an Exclusive Exploitation Authorization, the Contractor must prepare and submit to the Administration for approval a detailed development and production program specifying notably:

|

·

| |

item by item, the equipment and operations necessary for placement into production, such as the number of development wells, the number of platforms, the pipelines, the production, processing, storage and loading facilities required; |

|

·

| |

the corresponding cost estimates; |

|

·

| |

the projected schedule for performance of the above-mentioned work, equipment and facilities; |

|

·

| |

the estimated production starting date; |

|

·

| |

the estimate of recoverable reserves and annual Production. |

This development and production program must have been examined by the Technical Consulting Committee. in accordance with Article 2.2, before being submitted to the Administration together with the Committee’s advice, suggestions and recommendations.

20.2.If the Administration believes that modifications to the above-mentioned development and production program are necessary or desirable, it must inform the Contractor in writing, specifying the modifications which it requests, supported by those justifications which it may deem useful.

The Administration and the Contractor will then meet, as soon as possible, in order to examine the changes requested and prepare, through mutual agreement, the program in its final form. This program is considered approved on the date of said agreement.

In any case, the parts of the program for which the Administration did not request changes will be considered approved and the Contractor will be able to realize them within the initially planned periods of time.

If, at the time of expiration of the above-mentioned term, the Administration has not presented to the Contractor any request for modifications, the program is considered approved.

Article 21

OBLIGATIONS OF THE CONTRACTOR DURING

THE DEVELOPMENT AND EXPLOITATION PERIODS

21.1.Unless otherwise stipulated, Articles 5, 8, 10, and 11 of the Contract are applicable, mutatis mutandis, to Petroleum Operations conducted within the scope of the Exclusive Exploitation Authorizations.

21.2.Upon obtaining an Exclusive Exploitation Authorization, the Contractor agrees to proceed with diligence to drill the necessary development wells with such intervals between wells as to guarantee maximum economic recovery for the Parties, of the Hydrocarbons contained in the Field, in keeping with internationally accepted good practices in the Hydrocarbon industry.

Except for duly evidenced unusual circumstances, the Contractor must start these development operations no later than six months after acceptance by the Administration of the development and production program defined in Article 20.

21.3.In the performance of its production operations, the Contractor is required to observe all the internationally accepted standards and practices of the Hydrocarbon industry which make it possible to obtain optimum economic recovery of Hydrocarbons contained in the Field for the Parties.

21.4.The Contractor is required to proceed, as soon as technically feasible, with enhanced recovery program studies for the Field and to implement at the appropriate time this process if, under economic conditions acceptable to the Parties, it can lead to an improvement in the rate of recovery of the Hydrocarbons contained in the Field.

21.5.The Contractor agrees to provide the Administration with all the reports, studies, results from measurements, tests and trials, and documents which make it possible to verify the proper exploitation of the Fields in order to guarantee that the exploitation is being conducted in the proper conditions, in particular, in the light of the above provisions.

particular, it is required to carry out the following operations on each producing well:

|

·

| |

measurement of the production of Hydrocarbons daily, monthly and annually; |

|

·

| |

monthly control of the gas-oil ratio; |

|

·

| |

annual measurement of reservoir pressure, on a carefully selected group of wells, representing at least one half of the wells in the Field. |

The Contractor is required to implement every recommendations made by the Administration, in agreement with the Contractor, on the subject of conservation of the Fields and to comply with the regulations in effect regarding pollution and the safety of property and persons.

21.6.The Contractor is required to annually produce from each Field quantities of Hydrocarbons in accordance with generally accepted international Hydrocarbon industry practices, in particular in applying the standards for proper conservation of the Fields making optimal recovery of the Hydrocarbon reserves possible in minimal economic conditions for the Parties.

21.7.The Contractor contributes annually to a Hydrocarbon Support Fund created for the purpose of developing petroleum research in Gabon. Contractor’s contribution to the Hydrocarbon Support Fund is calculated on the basis of the Total Available Production equal to the C.F.A. Franc equivalent of US$ 0.05 per Barrel produced. This contribution will not be included in the Petroleum Costs.

The Hydrocarbon Support Fund will be managed by the Minister of Hydrocarbons.

Article 22

CONTRACTOR RIGHTS IN CONNECTION WITH

EXCLUSIVE EXPLOITATION AUTHORIZATIONS

22.1.Unless otherwise stipulated, Articles 9, 12, 13 and 14 of the Contract are applicable mutatis mutandis to Petroleum Operations conducted within the scope of Exclusive Exploitation Authorizations.

22.2.The Contractor is entitled, subject to regulations in effect, to build, utilize, operate and maintain all the Hydrocarbon production, storage and transportation facilities which are necessary for the production, transportation, delivery and loading of the products extracted, subject to the provisions of Article 10.3.

22.3.If no available or sufficient evacuation means exist, the Contractor can, under the conditions set forth by the regulations, construct a pipeline that will allow it to evacuate the production. To that end, the Contractor will submit for the approval of the Administration, and before the commencement of any work, plans corresponding to the layout it has established and to the projected location of all the pipelines it intends to build. All the pipelines crossing or running along roads or thoroughfares (other than those reserved for the Petroleum Operations) shall be built so as not to obstruct traffic. The conditions of transportation and the safety regulations for these structures will comply with the applicable regulations in force.

22.4.Within the limits of available capacity not used by the Contractor and at normal and nondiscriminatory prices, Contractor is required to allow free use by Third parties of the Hydrocarbon transportation, processing and storage infrastructures set up for the needs of the Petroleum Operations.

The pricing conditions applied shall be duly evidenced and submitted for approval to the Departments in charge of Hydrocarbons. The rate is to be established so that it permits recovery of the cost of operation of the installation, including a portion of the cost price of the facilities at least equal to the fiscal depreciation in effect or usually applied in Gabon and computed on the original acquisition value, plus a reasonable profit margin representing remuneration for the capital invested for the construction of the given infrastructure.

Article 23

PRODUCTION MARKETING OBLIGATION

23.1.As soon as the production of a Hydrocarbon Field becomes regular, Contractor is required to make every effort to ensure the best valorization of the extracted product such that the marketing of the share of these products to which it is entitled does not unfavorably affect the prices of Gabonese Hydrocarbons on the international market.

23.2.The Contractor is required to make every effort so that the prices obtained for exported Gabonese Hydrocarbons are in agreement with those existing on the international market at the time of the sale, for equivalent duality, quantity, freight and payment terms.

Article 24

RECOVERY OF PETROLEUM COSTS

24.1.The Contractor is entitled to recover the Petroleum Costs it has defrayed within the Delimited Area, by lifting a portion of the Hydrocarbon production exclusively from that area. The recovery of Petroleum Costs may not in any case be achieved by drawing on the production of Hydrocarbons from Fields outside the Delimited Area.

For the application of the foregoing paragraph, the Contractor shall keep a Petroleum Cost Account, in compliance with Article 26.9 and the Accounting Agreement.

24.2.Contractor is entitled to recover the Petroleum Costs after production begins and as production progresses.

This cost recovery right gives the Contractor the right to lift a portion of the Net Production. These liftings are limited to the balance of the Cost Account, and, for any Calendar Year, shall not exceed seventy (70%) percent of the Net Production obtained during said year.

The Hydrocarbons lifted by Contractor under the provisions of this Article are valued at the “Fixed Price” as defined in Article 27, for the purposes of the Petroleum Cost Account mentioned in Article 26.9.

24.3.The State will enjoy a preference right on the quantities of Hydrocarbons to which the Contractor is entitled within the scope of the recovery of Petroleum Costs, when these quantities are offered to Third Parties.

For the purposes of the application of the above provisions, the quantities of Hydrocarbons that are given over within the scope of exchanges required by technical constraints inherent in the Contractor’s facilities, or that are intended to save time and transportation efforts, will not be considered as sales to Third Parties but on the condition that the quantities exchanged are actually intended for meeting the Contractor’s needs or those of its Affiliated Companies.

In exchange for the quantities of Hydrocarbons that are purchased in application of the above provisions, the State will pay to the Contractor a sum equal to the product of said quantities times

the price agreed to by the Parties. This price is determined by reference to prices found on the international market at the time of the sale, for equivalent quality, quantity, freight and payment terms.

The amounts paid by the State to the Contractor within the scope of the preference right stipulated above will be posted to the credit of the Petroleum Cost Account, these therefore being considered as having been recovered in cash.

24.4.When the State exercises its preference right stipulated in Article 24.3, the Contractor will send to the Administration, no later than fifteen days following the date of the loading of the quantity of Hydrocarbons given over to the State, the corresponding invoice made out in United States dollars.

Within ninety days following the reception of that invoice, the State will effect payment in freely exchangeable currency, according to the regulations in force. The amount due will be paid into the Contractor’s account in a bank established in Gabon. Should the State not make payment in the above time frame, the amount due will carry an annual interest rate that is at most equal to the discount rate of the Bank of Central African States (B.E.A.C.)? If payment of an invoice is not made by the State within the above mentioned time frame, the preference right of the State is suspended for as long as the last invoice remains unpaid.

Regardless of the means employed to recover Petroleum Costs, by drawing from the Hydrocarbons in conformity with Article 24.2, by cash payments in application of Article 24.3, or by a combination of these two methods, the total recovery, during a Calendar Year, expressed in terms of the quantity of Hydrocarbons, may not, for any reason, exceed the percentage of the Net Production for that Calendar Year set in Article 24.2.

24.5.If in the course of a Calendar Year the Net Production from the Delimited Area fails to permit the Contractor to recover Petroleum Costs in application of the provisions of Articles 24.1 to 24.5, the amount of Petroleum Costs that are not recovered in that Calendar Year will be carried forward to succeeding Calendar Years until full recovery of the Petroleum Costs or expiration of the Contract.

24.6.In the event of the discovery in the Delimited Area of deposits producing Hydrocarbons of differing quality, the recovery of the Petroleum Costs shall be by payment in kind or payment in cash in accordance with this Article, by taking into account each of the qualities, proportionally to the Total Available Production.

Article 25

PRODUCTION SHARING

25.1.After deduction by the Contractor on a part of the Net Production for the recovery of the Petroleum Costs in application of the provisions of Article 24, the Remaining Hydrocarbon Production is shared between the State and the Contractor in the following terms:

(a)When the average daily Total Available Production from the Delimited Area for a given calendar month is equal to or less than ten thousand (10,000) Barrels, the Remaining Production is shared between:

|

·

| |

the State:fifty (50%) percent |

|

·

| |

the Contractor:fifty (50%) percent. |

(b)When the average daily Total Available Production from the Delimited Area for a given calendar month is greater than ten thousand Barrels and equal to or less than twenty-five thousand (25,000) Barrels, the Remaining Production is shared between:

|

·

| |

the State:fifty-five (55%) percent |

|

·

| |

the Contractor:forty-five (45%) percent. |

(c)When the average daily Total Available Production from the Delimited Area for a given calendar month is greater than twenty-five thousand Barrels, the Remaining Production is shared, between:

|

·

| |

the State:sixty (60%) percent |

|

·

| |

the Contractor:forty (40%) percent. |

In the event of a discovery in the Delimited Area of Hydrocarbons of different qualities, the sharing between the State and Contractor of the Remaining Hydrocarbon Production is made separately for each quality, proportionally to the Total Available Production.

The Contractor is entitled to its share of Hydrocarbons from the start of the production and as it develops.

25.2.The State draws its share of the production as defined in Article 25.1 above, in kind.

However, the Contractor is required, when requested by the State, .to sell all or part of the latter’s share of Hydrocarbons under the terms of the above-mentioned Article and reimburse the State. In this case, Contractor will make its best effort to obtain a sales price on the market at least equivalent to the “Fixed Price” defined in Article 27. When this operation occurs, Contractor will receive a sales commission in an amount established by mutual agreement with reference to the applicable customary business practice.

In the event Contractor is unable to sell the State’s share of the production at a price at least equal to the “Fixed Price”, Contractor will inform the State of the best price proposed. The State will then inform Contractor whether it accepts the sale price Contractor can obtain or prefers to receive the quantities involved in kind.

25.3.The State may request payment of the proceeds from sales of its production share made by the Contractor in the foreign currency of its choice. The choice of payment currency

shall be made known to Contractor at the time of the request mentioned in Article 25.2, second paragraph. In the absence of notification, payment shall be made in the currency in which the “Fixed Price” defined in Article 27 is expressed.

25.4.The State has a preference right on the Contractor’s share of production defined in Article 25.1, under the same conditions and following the same procedures as those set forth in Articles 24.5 and 24.4.

Article 26

FISCAL SYSTEM

In connection with the Petroleum Operations performed in the Delimited Area, the Contractor is subject to the following taxes and royalties:

(a)the bonuses specified in Article 28; these are payable in cash;

(b)a proportional mining royalty, during the production phase, the rates of which are defined as follows:

|

·

| |

three percent (3%) when the Total Available Production during a calendar month is equal to or less than five thousand (5,000) Barrels per day; |

|

·

| |

six percent (6%) when the Total Available Production during a calendar month is greater than five thousand (5,000) and equal to or less than seven thousand five hundred (7,500) Barrels per day; |

|

·

| |

nine percent (9%) when the Total Available Production during a calendar month is greater than seven thousand five hundred (7,500) and equal to or less than ten thousand (10,000) Barrels per day; |

|

·

| |

twelve percent (12%) when the Total Available Production during a calendar month is greater than ten thousand (10,000) and equal to or less than fifteen thousand (15,000) Barrels per day; |

|

·

| |

fifteen percent (15%) when the Total Available Production durng a calendar month is greater than fifteen thousand (15,000) and equal to or less than twenty‑five thousand (25,000) Barrels per day; |

|

·

| |

seventeen point five percent (17.5%) when the Total Available Production during a calendar month is greater than twenty‑five thousand (25,000) Barrels per day;’ |

The total Available Production subject to the proportional mining royalty is reduced by the following quantities:

(1)quantities lost or burned at the time of the production tests or at the production, gathering or storage facilities on the Exploitation Area, provided that the Contractor has abided by the applicable regulations and the guidelines and recommendations of the Administration on this matter;

(2)reinjected into the Field of the Exploitation Area;

(3)used for preparation of drilling fluids for the requirements of the Delimited Area;

(4)used for operations performed, after drilling, on wells of the Field of the Exploitation Area;

(5)consumed in the turbine engines providing the energy used:

(i)to drive the necessary pumping units on the wells of the Field of the Exploitation Area,

(ii)to gather the Hydrocarbons on the Exploitation Area,

(iii)to operate the drilling facilities established on the Delimited Area for the requirements of said Area.

The quantities lifted or used downstream from the point where the Total Available Production is discounted for the above-mentioned requirements are acceptable deductions from the proportional mining royalty base only after exceptional authorization from the Administration, issued upon justified request from the Contractor.

The proportional mining royalty is paid either in kind or in cash, at the State’s option. If the latter has failed to let its choice be known, it will be considered having opted for payment in cash.

When the proportional mining royalty is paid in cash, it is computed on the FOB value of the Hydrocarbons. For determination of this FOB value, the price adopted is the “Fixed Price” defined in Article 27.

Payment in cash of the proportional mining royalty is made to the office of the tax collector not later than the twenty-eighth of each month, on the basis of the average monthly production of the preceding calendar quarter. Adjustment is made not later than January 28th of each year, for the preceding Calendar Year, on the basis of the taxable Total Available Production of said year and of the corresponding “Fixed Price”.

At the start of production and during the period when the above-mentioned average monthly production cannot be determined, the amount of the royalty is calculated on the basis of the effective production of each month considered and is paid within the same above-mentioned periods of time.

If the State wishes to receive in kind all or part of the proportional mining royalty, it advises the Contractor in writing to this effect at least one hundred eighty days in advance, specifying the quantity which it wishes to receive in this form during the period considered.

The proportional mining royalty is not included in the Petroleum Costs.

(c)the annual surface royalty set forth by the regulations in effect. This royalty, included in the Petroleum Costs, is paid in cash, in advance and per full Calendar Year, on the basis of the surface area held on January 1st of each year and, for the first year, on the surface area held on the Effective Date7.

(d)the duties and taxes collected at the time of importation by the Customs Administration, such as defined in Article 34;

(e)The Tax on Profits and Revenues (Corporate Tax), which each entity forming the Contractor has to pay and which is calculated applying the general tax rate in force and in accordance with the provisions of Article 26.1. Payment of the Corporate Tax is made to the appropriate tax administration, by the State, for the account of the above mentioned entities. In accordance with Article 26.3, this quantity is included in the portion due to the State under provisions of Article 25.1.

The Corporate Tax thus due for a given Calendar Year and paid to the State in kind, is determined on the basis, notably, of the gross revenue consisting of the turnover from the quantity of Hydrocarbons available thereto in application of Articles 24 and 25, or their equivalent in cash, as well as from the quantities delivered to the State as payment for the Corporate Tax and, on the other hand, from deductible expenses, including the bonuses as defined in Article 28, the cost of materials, interests, and payments into the Hydrocarbon Support Fund, as defined in Article 21.7, as indicated and defined in the tax laws in effect and in Article 26.1. The pertinent taxable profit is that from the Annual Statistical and Fiscal Declaration mentioned in Articles 26.4 and 26.5.

26.2.In regards to the fiscal and customs regulations, each company which makes up the Contractor is treated as a distinct entity. However, if one of these units does not meet its fiscal obligations resulting from this Contract, the other entities will be substitutes thereof.

26.3.The quantity of Hydrocarbons which the State receives during any Calendar Year in application of Article 25.1 includes:

(a)the part representing the mining rights other than the annual surface royalty and the proportional mining royalty as defined in Article 26.1 above;

(b)and, in accordance with the provisions of the above Article 26.1 e), the part which represents .the corporate tax to be imposed on the companies which make up

the Contractor of the Hydrocarbon operations carried out in the Delimited Area, and computed at the rates defined in the tax laws in effect.

26.4.Each company forming the Contractor will keep, by Calendar Year, separate accounting records for the Petroleum Operations, rendering it possible to determine, in particular, the profit and loss balance statement and a detailed balance sheet showing both the results of said operations and the assets and liabilities pertaining and related thereto. This accounting system must be in compliance with the applicable regulations in effect in Gabon, such as the General Accounting Plan for Companies. It has to include, in particular, all the data required for the preparation of the Annual Statistical and Fiscal Statement and its attachments.

26.5.Each of the companies forming the Contractor is required to deliver to the person responsible for the Departments in charge of Hydrocarbons, not later than April 30 of each year, a copy of the tax return regarding the Corporate Tax pertaining to the previous Calendar Year, such as required by the applicable tax regulations.

The profit and loss account and the balance sheet must clearly show the amount of amortization and of write-offs done during the year. As far as the expenditures which have not yet been amortized are concerned, these amortizations are calculated and accounted for as the difference, if it is positive, between the maximum of the Cost Recovery Account as defined in Article 24.2 and the total of the charges debited to the profit and loss account.

26.6.The Tax Administration, after examining the above-mentioned documents, will issue to each one of the companies forming the Contractor, within sixty days after the date of presentation, the originals of the tax statements and all other documents certifying that it has met its fiscal obligations resulting from the applicable regulations, subject to the Administration’s rights to audit and recovery set forth by the regulations in force.